Cyberpunk RED: Black Chrome ⎯ A Comprehensive PDF Guide

Black Chrome is an essential expansion for Cyberpunk RED, delivered as a detailed PDF, offering extensive solo play options and rule enhancements for immersive experiences․

What is Cyberpunk RED Black Chrome?

Cyberpunk RED Black Chrome is a substantial expansion to the Cyberpunk RED tabletop role-playing game, specifically designed to facilitate and enhance solo play․ Released as a digital PDF, it doesn’t just adapt the core rules for a single player; it actively expands upon them․

This isn’t a simple “one player versus the game master” conversion․ Instead, Black Chrome introduces the CORE system – a robust set of tools for generating missions, creating dynamic Non-Player Characters (NPCs), and simulating a living, breathing Night City even without a traditional GM․

Beyond solo play, the PDF also includes significant additions to the core rule set, including new lifepaths, detailed combat modifications, and expanded cyberware interactions, enriching the overall Cyberpunk RED experience for any group․

The Core Concept: Solo Play & Expanded Rules

At its heart, Cyberpunk RED Black Chrome centers around two key pillars: empowering solo adventurers and significantly broadening the existing game rules․ The CORE system, the expansion’s defining feature, allows players to generate compelling narratives and challenges independently, removing the need for a Game Master․

This is achieved through structured random tables and procedural generation tools, ensuring each playthrough feels unique and unpredictable․ However, Black Chrome isn’t solely focused on solo play․

The PDF also delivers a wealth of new content – lifepaths, combat options, and cyberware rules – that seamlessly integrate into traditional Cyberpunk RED campaigns, offering GMs and players alike a richer, more detailed Night City experience․

Obtaining the Cyberpunk RED Black Chrome PDF

Black Chrome, as a digital product, is readily available for purchase through several official channels and authorized digital distribution platforms online․

Official Purchase Options

Black Chrome is best acquired through legitimate sources to ensure you receive the complete and supported PDF version․ This directly benefits the creators at R․ Talsorian Games, allowing them to continue producing high-quality Cyberpunk RED content․ Purchasing officially guarantees access to all included materials, including the detailed rules expansions, new lifepaths, and the innovative CORE solo play system․ You’ll also be supporting the future development of the Cyberpunk RED universe․ Avoid unofficial sources, as these may contain incomplete or altered files, potentially impacting your gaming experience and lacking crucial updates or errata․ Opting for official channels is the ethical and reliable way to enjoy this fantastic expansion․

R․ Talsorian Games Website

R․ Talsorian Games’ official website is the primary and most direct source for purchasing the Cyberpunk RED: Black Chrome PDF․ Visiting their site (https://www․rtalsoriangames․com/) ensures you’re getting a legitimate, DRM-free copy of the expansion․ You’ll find it listed in their digital storefront, often alongside other Cyberpunk RED materials․ Purchasing directly from R․ Talsorian Games provides the highest percentage of support to the creators, fueling future projects․ They frequently offer bundles and promotions, potentially saving you money if you’re expanding your Cyberpunk RED collection․ The website also provides easy access to customer support should you encounter any issues with your purchase or download․

Digital Distribution Platforms (DriveThruRPG, etc․)

Several digital distribution platforms offer the Cyberpunk RED: Black Chrome PDF, providing convenient alternatives to the official website․ DriveThruRPG (https://www․drivethrurpg․com/) is a prominent example, known for its extensive catalog of tabletop RPG materials․ Other platforms like GOG․com may also carry the PDF occasionally․ These platforms often run sales and promotions, potentially offering the PDF at a discounted price․ They also handle the digital delivery and DRM aspects, ensuring a smooth download experience․ Utilizing these platforms supports both R․ Talsorian Games and the distributors themselves, contributing to the wider tabletop RPG ecosystem․

Legality and Ethical Considerations

Cyberpunk RED: Black Chrome, like all creative works, is protected by copyright law․ Obtaining the PDF through unauthorized channels – such as torrents or unofficial download sites – constitutes piracy and is illegal․ This harms R․ Talsorian Games, hindering their ability to create future content for the Cyberpunk RED universe․ Supporting the creators financially ensures continued development and quality products․ Choosing legitimate purchase options demonstrates respect for their work and the tabletop RPG hobby․ Ethical consumption fosters a sustainable environment for game designers and publishers, benefiting the entire community․

Avoiding Pirated Copies

Cyberpunk RED: Black Chrome pirated PDFs often circulate online, but these come with significant risks․ They may contain malware, viruses, or incomplete/corrupted files, compromising your device’s security․ Furthermore, the quality is often poor, with missing pages or illegible text, ruining the gaming experience․ Supporting official channels guarantees a clean, complete, and legally obtained copy․ Be wary of “free” downloads from untrusted sources; they are rarely legitimate․ Stick to the R․ Talsorian Games website or authorized digital distributors like DriveThruRPG to ensure a safe and enjoyable experience with this fantastic expansion․

Supporting the Creators

Purchasing an official Cyberpunk RED: Black Chrome PDF directly supports R․ Talsorian Games and the talented individuals who poured their creativity into its development․ Your purchase enables them to continue producing high-quality tabletop role-playing game content, including future expansions and new worlds․ It’s a direct investment in the hobby you love, ensuring its continued growth and innovation․ By choosing legitimate sources, you contribute to a sustainable ecosystem for game designers and publishers․ Show your appreciation for their hard work and dedication – choose official, paid options for your Black Chrome PDF!

Navigating the Black Chrome PDF

Black Chrome’s PDF is expertly crafted for ease of use, featuring interactive elements and a comprehensive bookmark system for quick access to vital content․

PDF Features & Bookmarks

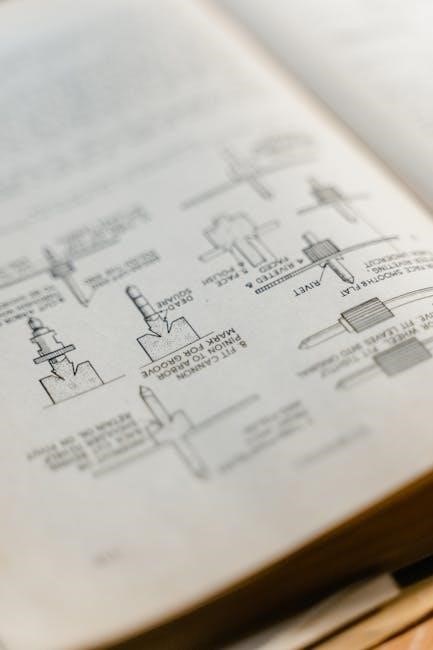

The Cyberpunk RED: Black Chrome PDF isn’t just a digital replica; it’s a dynamically enhanced document․ Fully bookmarked, navigating the 200+ pages is streamlined, allowing GMs and players to instantly jump to specific rules, lifepaths, or sections on the CORE system․

Hyperlinks connect related content, fostering a non-linear reading experience․ Interactive character sheets and fillable forms are included for streamlined play․ The PDF is also optimized for various screen resolutions, ensuring readability on tablets, laptops, and desktop monitors․ Layered PDFs allow for optional display of GM-only content․ Expect a visually appealing layout with clear typography, making information readily accessible and enjoyable to explore․

Understanding the Document Structure

The Black Chrome PDF follows a logical progression, building upon the foundation of the Cyberpunk RED Core Rulebook․ It begins with an introduction to the expanded setting elements, then dives into new lifepaths like the Corporate Agent and Fixer․

Subsequent sections detail the revised combat rules, focusing on weapon modifications and cyberware interactions․ A significant portion is dedicated to the CORE system for solo play, outlining mission generation and NPC behavior․ Appendices contain quick reference tables and supporting materials․ The document is clearly divided into chapters and sub-chapters, making it easy to locate specific information and integrate it into your game․

Key Content Within the Black Chrome PDF

Black Chrome’s core lies in expanded lifepaths, detailed combat revisions, and the innovative CORE system, providing robust tools for solo adventures and campaign enrichment․

New Lifepaths

Black Chrome introduces compelling new Lifepaths, dramatically expanding character creation possibilities within the Cyberpunk RED universe․ These aren’t simply reskins; they offer unique backgrounds, skills, and connections, deeply influencing gameplay․

The Corporate Agent Lifepath allows players to embody the ruthless efficiency of megacorporate security or intelligence operatives, navigating complex internal politics and high-stakes missions․ Conversely, The Fixer & The Media presents a dual path, letting players become information brokers or investigative journalists, thriving in the shadows and uncovering dangerous truths․

Each Lifepath includes detailed backstory generators, suggested motivations, and starting gear, ensuring a rich and immersive character experience․ They are designed to seamlessly integrate with existing Lifepaths, fostering diverse and dynamic player groups․

The Corporate Agent

The Corporate Agent Lifepath in Black Chrome embodies the power and peril of working for a megacorporation․ Players assume the role of individuals fiercely loyal – or strategically compliant – with their employer’s agenda․ This Lifepath focuses on internal security, wetwork, intelligence gathering, and corporate espionage․

Characters originating from this path typically possess advanced training in combat, security protocols, and information technology․ They often have access to cutting-edge cyberware and weaponry, though always under strict corporate control․ Backstory elements explore the agent’s relationship with their corporation, their motivations for loyalty, and any potential conflicts of interest․

Expect missions involving protecting corporate assets, eliminating rivals, and uncovering internal threats․ This Lifepath thrives on intrigue, deception, and calculated risk-taking within the cutthroat world of Cyberpunk RED․

The Fixer & The Media

Black Chrome introduces The Fixer & The Media as a combined Lifepath, representing those who navigate the information streams and underworld connections of Night City․ Fixers are masters of networking, procuring illicit goods, and arranging discreet services, while Media personnel – reporters, broadcasters, and data brokers – shape public perception․

This Lifepath emphasizes social skills, streetwise knowledge, and access to valuable contacts․ Characters might be independent operators or employed by larger organizations, constantly balancing risk and reward․ Backstory focuses on their reputation, sources, and any debts owed or favors granted․

Expect missions involving uncovering secrets, manipulating events, and brokering deals in the shadows․ This path excels at information warfare, leveraging influence, and exploiting opportunities within the Cyberpunk RED setting․

Expanded Combat Rules

Black Chrome significantly refines Cyberpunk RED’s combat system, adding layers of tactical depth and realism․ These aren’t wholesale changes, but nuanced additions designed to heighten tension and strategic decision-making during firefights and close-quarters engagements․

The expansion introduces more granular rules for cover, suppression, and flanking maneuvers, forcing players to consider positioning and teamwork․ New actions allow for more dynamic responses to threats, beyond simple attack and defend options․

Furthermore, Black Chrome delves into the interplay between cyberware and combat, detailing how augmentations can affect actions, vulnerabilities, and overall effectiveness in a firefight․ Expect a more challenging and rewarding combat experience․

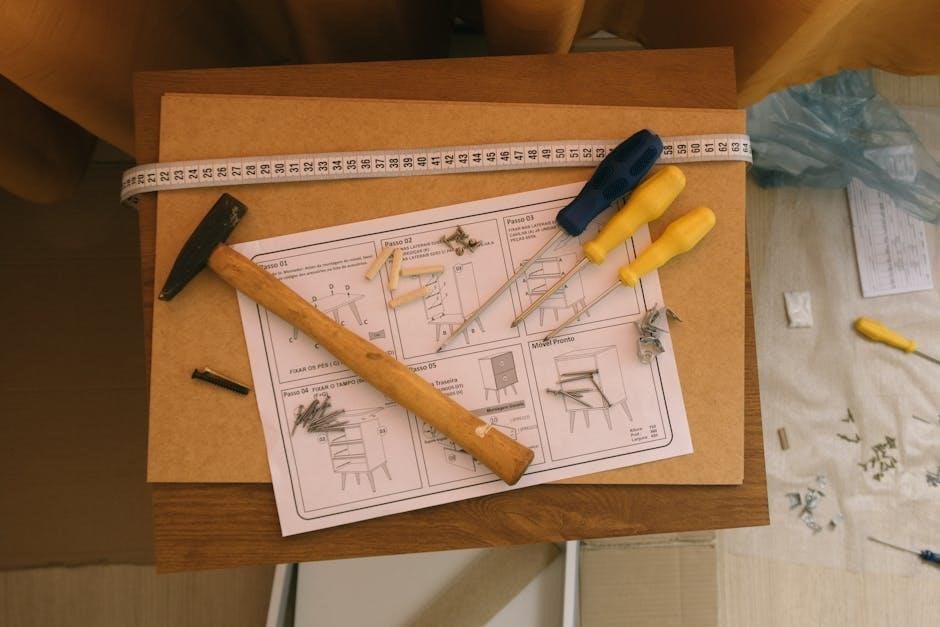

Advanced Weapon Modifications

Black Chrome elevates weapon customization in Cyberpunk RED, moving beyond simple attachments․ The PDF details a robust system for truly unique and specialized firearms, offering a wealth of options for both players and fixers seeking to outfit their operatives․

Expect detailed rules for internal modifications, altering weapon stats and adding entirely new functionalities․ These aren’t just cosmetic changes; they impact accuracy, damage, range, and even weapon handling characteristics․

The guide provides extensive lists of components, costs, and installation requirements, alongside potential drawbacks and risks associated with pushing weapon technology to its limits․ Crafting the perfect weapon becomes a significant undertaking․

Cyberware Interactions in Combat

Black Chrome significantly expands how cyberware functions during firefights in Cyberpunk RED․ The PDF introduces nuanced rules governing cybernetic enhancements’ impact on combat actions, going beyond simple stat bonuses․

Expect detailed guidelines on how cybernetic reflexes affect initiative, how optical enhancements influence targeting, and how implanted weaponry integrates with standard firearms․ The document clarifies potential glitches and malfunctions, adding risk to reliance on cybernetics․

Furthermore, the guide explores interactions between different cyberware types, creating synergistic effects or unforeseen complications․ Combat becomes a dynamic interplay between flesh, metal, and code, demanding tactical awareness․

Solo Play Mechanics – The CORE System

Black Chrome’s centerpiece is the CORE (Cyberpunk Operational Response Engine) system, a robust framework for solo adventures in the Cyberpunk RED universe․ This isn’t just a set of random tables; it’s a dynamic system designed to simulate a responsive Game Master․

CORE utilizes a series of interconnected tables and prompts to generate missions, NPCs, and unexpected twists․ The system reacts to player choices, creating a narrative that feels organic and unpredictable․ It handles everything from initial job offers to escalating conflicts․

The PDF provides extensive guidance on interpreting CORE’s outputs and weaving them into a compelling solo campaign, ensuring a rich and engaging experience even without a traditional GM․

Generating Missions with CORE

Black Chrome’s CORE system generates missions through a layered process, beginning with a “Hook” – the initial reason a job presents itself to the player character․ This hook is determined by rolling on specific tables, considering factors like the character’s Lifepath and current location․

From the Hook, CORE expands the mission with complications, contacts, and potential rewards․ The system doesn’t dictate a rigid storyline; instead, it provides building blocks for a dynamic narrative․ Players actively shape the mission’s direction through their choices․

The PDF details how to interpret CORE’s results, offering guidance on connecting disparate elements into a cohesive and exciting adventure, ensuring each solo run feels unique and unpredictable․

NPC Creation & Behavior

Black Chrome streamlines NPC creation for solo play using the CORE system․ Rather than fully statting characters, the system focuses on key traits – Motivation, Appearance, and a defining Skill․ These elements quickly establish memorable individuals without extensive preparation․

The PDF provides tables for generating these traits, ensuring diverse and believable NPCs․ Behavior is dictated by their Motivation, influencing how they react to the player character’s actions․ CORE offers guidelines for interpreting NPC responses, adding unpredictability․

This approach allows for dynamic interactions, even without a Game Master, fostering a sense of a living, breathing world․ Quick NPC generation keeps the focus on the story, not the bookkeeping․

Utilizing the PDF for Game Mastering

Black Chrome’s content enriches traditional Cyberpunk RED campaigns, providing GMs with tools for dynamic storytelling and expanded world-building possibilities․

Adapting Black Chrome to Your Campaign

Black Chrome isn’t a replacement for the core Cyberpunk RED rulebook, but a powerful supplement․ Integrating its elements requires thoughtful consideration of your existing campaign’s tone and focus․ The new Lifepaths, like the Corporate Agent, can be seamlessly introduced as background options for player characters, enriching their histories and motivations․

The expanded combat rules, particularly weapon modifications and cyberware interactions, can be adopted gradually, perhaps starting with a limited selection to avoid overwhelming players․ The CORE system is exceptionally versatile; use it to generate side quests, entire arcs, or even to populate the background of your Night City setting with dynamic events․ Remember to tailor the difficulty and themes to match your group’s preferences, ensuring a cohesive and engaging experience․

Integrating Black Chrome with the Core Rulebook

Successfully blending Black Chrome with the Cyberpunk RED core rulebook hinges on understanding how the expansion enhances, rather than replaces, existing systems․ Cross-reference the core rulebook when utilizing new combat options; Black Chrome’s modifications build upon established mechanics․ When introducing new Lifepaths, ensure players understand how they interact with core character creation rules, like skill point allocation and starting gear․

The CORE system functions best when viewed as a GM tool for improvisation and world-building, complementing pre-planned storylines․ Don’t hesitate to adapt CORE-generated elements to fit your campaign’s narrative․ Regularly referencing both books during play will ensure a smooth and consistent gaming experience, maximizing the benefits of both resources․

Troubleshooting PDF Issues

Black Chrome PDF problems are often easily solved; ensure your reader is updated, check file integrity, and verify sufficient system resources for optimal viewing․

PDF Reader Compatibility

Cyberpunk RED: Black Chrome, being a richly formatted PDF, functions best with modern PDF readers․ Adobe Acrobat Reader DC is the officially recommended software, offering full feature support and consistent rendering of the document’s complex layout, including interactive elements like bookmarks and hyperlinks․

However, alternatives like Foxit Reader and even web browsers (Chrome, Firefox, Edge) can generally display the PDF, though some advanced features might be limited․ Compatibility issues often arise with older PDF readers that lack support for newer PDF specifications․ If you encounter display errors – such as missing fonts, incorrect formatting, or broken links – updating your PDF reader is the first troubleshooting step․ Ensure it’s the latest version for optimal performance․

Common Errors & Solutions

Cyberpunk RED: Black Chrome PDF users occasionally encounter issues․ Missing fonts are solved by ensuring font embedding is enabled in your PDF reader settings, or manually installing the required fonts․ Hyperlink failures often stem from outdated reader versions; updating usually fixes this․ Display glitches (misaligned text, broken images) can be resolved by clearing your PDF reader’s cache․

If the PDF appears corrupted, re-downloading from the official source is crucial․ Slow performance with large PDFs can be improved by disabling hardware acceleration within your reader․ For persistent problems, consult the R․ Talsorian Games support forum – other users may have encountered and solved similar issues․ Always prioritize a legitimate PDF copy!